02.22.09

Why You Invest When the Market Goes Down

The S&P 500 certainly hasn’t made anyone rich over the last year:

Most people see this and think “an investment one year ago would have lost 45% of its value”. Others think “great, now stocks are all cheaper!”

In reality, most ordinary people invest portions of their paychecks, either through their 401(k) or a personal account. This means they’re doing time averaging. Sure, investments when the market was up aren’t doing well. But investments when the market was down are doing just fine.

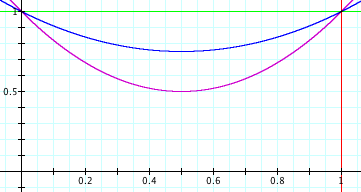

This is all kind of wishy-washy, though. Let’s try to quantify it. Suppose a market drop and recovery looks like a parabola:

The prices here are parabolas

for various values of a. a=0 means the market is flat. a=0.5 means the market loses 50% of its value.

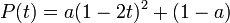

If you invest dt dollars in this market at each point in time, you can work out a nasty integral and show that the number of shares you have at time t is:

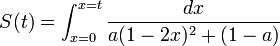

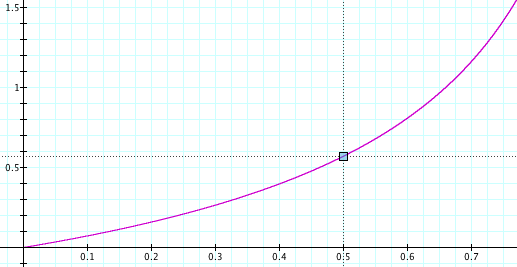

and hence the value of your shares at the end is:

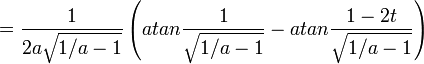

Here’s what that looks like:

The x-axis is a, the fraction by which the market drops. The y-axis is your total return on investment. If the market drops by 50% (a=0.5) then your total return on investment is around 55%. With time-averaging, the more the market drops, the better you do.

This makes a lot of sense if you think about it. Say the market drops 99.9% and then recovers. The shares you bought when it was at its bottom earned you a return of 1000x. Investing at the bottom is important! You should keep investing, even as the market drops. If you don’t, you’ll miss that bottom.

Sam said,

February 22, 2009 at 3:36 pm

You have overlooked things like survivorship bias, one example being that the companies which are currently listed on the falling index are not necessarily the same companies that will be listed on the recovering index. Your investments may become literally worthless, and although the “too big to be allowed to fail” mantra has much support within governments it has obvious theoretical limits.

For your model to work you have to assume that you’re investing widely enough to get total proper full-index coverage (ie shares in all the traded companies, probably via a managed index fund of some kind), and that you’re able to buy into new listings at the same price as that at which your de-listed (insolvent?) holdings can be sold (ie low, or possibly zero.)

Don’t get me wrong – I like the buy-low-sell-high concept. It’d just be a shame if people thought that buying into a “low” market was sure thing. Never invest more into stocks than you can afford to lose. There is a small, but significant, chance that none of your investment will ever be recoverable. And as soon as you start picking companies rather than investing into a cross-index balanced-risk fund then you start playing a completely different game… be that for better or worse ;)

As it happens – I have been investing (modest) fixed amounts into a pair of funds throughout the decline, and I hope to keep the investments up until we see a recovery. Do I think we are at, or near, the bottom of the market? No idea. Do I think my method will yield a good return? Or a better return than “cash under the mattress”? Again, No idea. But at least it gets done (its automated) and that is the massively overwhelming argument for this strategy in my book ;)

danvk said,

February 22, 2009 at 3:52 pm

Sam: I was imagining the prices here being for a pretty broad index like the S&P 500 or the Wilshire 5000. If a company in the S&P 500 goes under, that adversely affects the price of the index, correct?

jb said,

February 24, 2009 at 1:53 pm

“there is a small but significant chance that none of your investment will ever be recoverable”

If the entire S&P 500 index fails, we have much, much bigger problems than a return on our investments. For the S&P 500 to fall to zero we would essentially have to have a global catastrophe wiping out virtually all human life.